What is hospital price transparency? It allows patients to see what a particular service or treatment will cost at a specific hospital and lets them make comparisons between healthcare providers.

Since Jan. 1, 2019, hospitals in the U.S. have been required to post a list of their prices online in a machine-readable format. The price lists need to be kept up-to-date and include every service and item the hospital provides.

Those in favor of hospital pricing transparency argue that withholding this information prevents patients from making an informed decision. After all, no other industry gives people the price of a product or service only after they have purchased it. When someone goes grocery shopping, they know exactly how much they need to pay before they leave the store with their purchases. They don't wait to receive a surprise invoice in the mail four to six weeks later.

Hospital price transparency will certainly change the way the current system works. For example, the new rule could highlight the difference between a hospital's standard price for a procedure and how much a payer reimburses the provider. This could lead to disagreements over who should pay what.

But another interesting outcome of the new legislation is that it will become clear that more expensive doesn't mean better when it comes to healthcare. With time, the law may completely eliminate this common misperception and reward hospitals and physicians that do the best job vs. the ones that charge the most for it.

Early Impact of Price Transparency

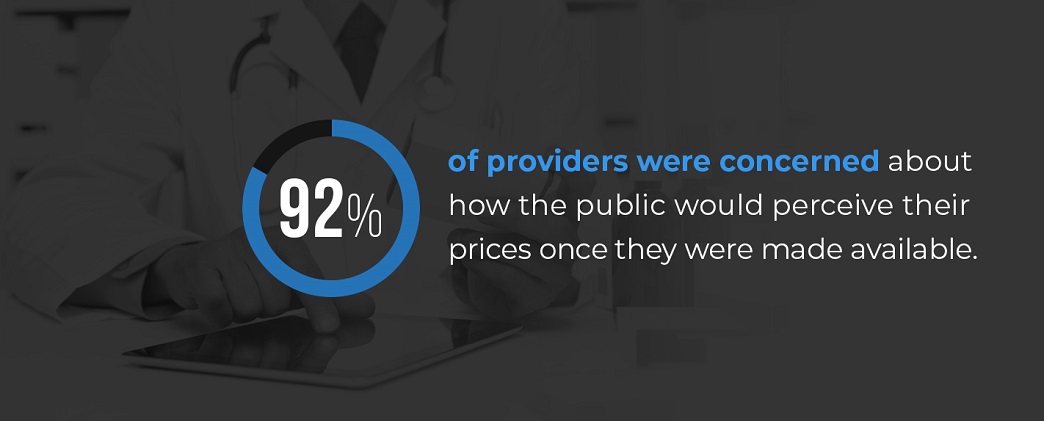

A poll taken before the hospital pricing transparency law took effect found that the vast majority of providers, 92%, were concerned about how the public would perceive their prices once they were made available. The same poll revealed:

- More than 40% of providers weren't sure how they would go about publishing their prices.

- Less than 30% said they would provide their standard prices, along with additional pricing information.

- About one-quarter stated they would only publish standard pricing.

In addition to initial uncertainty about what type of pricing information to share and how to share it, many providers believed publishing price lists, also known as chargemasters, would not provide many, if any, benefits to patients. In part, that is because the chargemaster price has little in common with the price a patient might pay out-of-pocket for a service. The costs included in a chargemaster are the maximum amount a hospital may charge for an item or service.

Variations in Healthcare Pricing

Once chargemaster lists made their way online, an examination of prices at hospitals in several cities revealed there was considerable variation in the pricing among hospitals. Often, there was little or no explanation for the differences in chargemaster costs. As these examples show, the differences amounted to hundreds or even thousands of dollars.

1. Price of Saline

The published price of saline ranged from $56 per liter to more than $432 per liter:

- Kaiser Permanente-Oakland and Richmond: $56.00

- Alta Bates Summit Medical Center: $75.00

- University of Minnesota Medical Center: $104.00

- UCSF Benioff Children's Hospital: $124.30

- Highland Hospital: $129

- Children's Hospital Los Angeles: $146.00

- Keck Hospital of USC: $264.21

- Kaiser Permanente-Los Angeles: $272.00

- Cedars-Sinai Medical Center (LA): $383.00

- New York-Presbyterian Hospital: $472.50

2. Price of a Complete Blood Count With Differential

There was also considerable variation in the price of a complete blood count with differential at hospitals across the country:

- Keck Hospital of USC: $59.86

- Children's Hospital Los Angeles: $60.20

- New York-Presbyterian Hospital: $61.39

- Kaiser Permanente-Oakland and Richmond: $106.00

- Kaiser Permanente-Los Angeles: $114.00

- University of Minnesota Medical Center: $133.00

- Alta Bates Summit Medical Center: $146.00

- Highland Hospital: $253.00

- UCSF Benioff Children's Hospital: $372.00

- Cedars-Sinai Medical Center (LA): $525.46

3. Price of a Brain MRI With Contrast

Hospitals also publish a range of prices for a brain MRI with contrast:

- University of Minnesota Medical Center: $1,721.00

- Highland Hospital: $3,211.00

- Children's Hospital Los Angeles: $3,781.00

- New York-Presbyterian Hospital: $4,030.00

- Kaiser Permanente-Los Angeles: $4,492.00

- Alta Bates Summit Medical Center: $5,011.00

- UCSF Benioff Children's Hospital: $5,034.00

- Keck Hospital of USC: $6,081.72

- Kaiser Permanente-Oakland and Richmond: $6,772.00

- Cedars-Sinai Medical Center (LA): $8,793.80

Comprehending Price Lists

As providers introduced chargemaster lists to their websites, another issue became apparent. Without a comprehensive understanding of medical billing codes and medical abbreviations, it can be challenging for the average healthcare consumer to understand what services are included on the list.

Even if a healthcare consumer has a general idea of what an abbreviation might mean, there is little information available to help them distinguish between two similar but potentially very different procedures. Critics claim these inconsistencies mean publishing the lists actually provides little benefit to patients who would struggle to understand them.

Where Are the Price Lists?

Critics also charge it can be difficult for the average person to locate pricing lists on a hospital's website. A pair of journalists tested this theory. After examining the sites of 115 large U.S.-based hospitals, reporters for Quartz were able to find price lists for 105 of those hospitals. It took the reporters, on average, more than three clicks per site to locate the chargemaster lists.

Of the 10 websites where Quartz writers were unable to access price lists by clicking through pages, they found the chargemaster lists of six hospitals after performing a Google search. They used the name of the hospital and phrases such as "price list" or "chargemaster" to track down the lists.

When its reporters did find price lists directly on the websites, Quartz noted that they were often in illogical locations. Some hospitals published their lists in the legal section of their sites, others on the Frequently Asked Questions page. In one case, a hospital included a link to its chargemaster list in the fine print at the bottom of the page.

Patient Advantages of Price Transparency

There are many potential advantages of price transparency for patients. Patients can compare hospital services and products to each other. They can make sure they have the money for a procedure before going ahead. They can choose the better doctor if they know there's a small price differential between that physician and a less reputable one.

Of course, this all depends on accessibility for patients. One way to make hospital pricing more comprehensible for patients is for a patient to work with the financial services staff at a hospital as well as with their insurance carrier.

Both the healthcare provider and payer can work together to provide a patient with an estimate for their cost of care. The estimate is likely to be based on:

- The patient's specific treatment plan

- The number of tests they need

- Their insurance policy

- The risk of complications occurring

- How long the patient will need to stay in the hospital

Making Healthcare More Shoppable

The argument behind the push for healthcare price transparency is to allow consumers the opportunity to price shop and get the best possible price for care. Seema Verma, the administrator of the Centers for Medicare & Medicaid Services (CMS), has compared hospital price transparency to the process of shopping for groceries or a car. She's argued that when people shop for other items, they can do research first to compare the prices and quality of the products.

As chargemaster lists rarely reflect a patient's real out-of-pocket healthcare costs, the current system is not analogous to car or grocery shopping. The numbers included in a hospital price list are often a starting point for negotiation with insurers and thus are increased with that in mind. That means these numbers do not reflect the amount the patient ultimately pays.

One way to make healthcare more shoppable and to allow patients the opportunity to compare prices is to give them access to price information on things they can compare. For example, the list might include out-of-pocket prescription drug prices or imaging costs at local hospitals. The patient understands they will get the same product or service no matter which hospital they go to.

Highlighting Typical Patient Outcomes

Another way to make healthcare more shoppable and help patients compare prices accurately is to highlight the typical outcomes of a particular procedure. Patients often correlate higher-priced care with better care, but that is not always the case. Data can back up effectiveness arguments. For instance, say a patient is trying to decide between cortisone shots (Option A) and surgery (Option B):

- Option A might cost less, but it also has a track record of helping more patients get better compared to Option B.

- Option B might have a higher price tag but be less effective.

Of course, sometimes the higher-priced option could be the more effective one. Either way, equipping the patients with data and information will allow them to look beyond the price and common assumptions to choose the product or service that will best help them.

Making Pricing Lists More Accessible

How pricing information is presented to patients can also influence whether it benefits them or not. The typical chargemaster list is a long spreadsheet full of indecipherable abbreviations and confusing codes. It doesn't group services or products a patient might need when receiving a particular treatment or procedure.

A woman delivering a baby might need to piece together multiple products and services to find out how much delivery will cost her. She might not know what type of birth she is going to have or what items will need to be included in the process. Packaging the pricing information together would allow patients to gain a better understanding of their cost of care.

Why More Expensive Doesn't Mean Better Care

Studies have found no correlation between higher cost and quality of care. More expensive services do not necessarily buy patients a better outcome or hospital experience. There are many reasons for this.

Patients Make Assumptions Based on Costs

With the publication of chargemaster lists, there is often little information available about the quality of service or products a patient will receive. After comparing the price of saline at Kaiser Permanente-Oakland and Richmond ($56) and Kaiser Permanente-Los Angeles ($272), someone might assume the saltwater available at Kaiser Permanente-Los Angeles is of better quality or a more dependable product compared to the saline from Kaiser Permanente-Oakland and Richmond.

Although a higher price doesn't mean better care, patients may make that assumption. If they see that a brain MRI costs $4,000 at one nearby hospital and only $2,000 at another local hospital, they might choose the more expensive hospital. The assumption is that they will get a better result if they pay more money.

The Placebo Effect of Higher Pricing

Assuming that a higher price tag equals better quality or effectiveness is common. In one study, participants were told they were given either a "name-brand" aspirin that cost $2.50 per pill or a generic one costing ten cents per pill. The participants were given an electric shock before they took the aspirin and a second shock after taking the medicine:

- About 85% of participants who took the name-brand, pricier aspirin claimed that they noticed an improvement in their comfort level with the second shock.

- Just 61% of participants who took the ten-cent aspirin said the same.

In reality, both groups received the same pill, a placebo that wasn't aspirin at all. The group that took the pill they believed cost more became convinced of its greater effectiveness.

When presented with limited information, such as a chargemaster list and nothing more to go on, it is only natural for consumers to pick the pricier option. That can translate to higher costs for their insurance providers, which can then lead to an increase in the consumers' insurance premiums the next year.

Giving Consumers Tools to Compare

The researchers who conducted the aspirin study were surprised by the results and the impact the price of a pill could have on perceptions of its effectiveness. One way to counter the price bias that many healthcare consumers develop, the researchers argued, would be to provide proof of a medication's efficacy.

Fact sheets detailing the benefits of a particular medication or procedure, even if it is a lower-priced option, can help to convince patients that it is the appropriate choice for them. Patient testimonials and statistics showing the outcomes of a procedure can also provide patients with the tools they need to compare products and services available at one hospital (and their costs) to the products and services available from a second provider.

Pricing Transparency and Self-Funded Plans

With a self-funded plan, an employer assumes the financial responsibility of covering its employees' healthcare costs. It collects premiums from the employees covered by the plan and makes its own contributions to the plan. Ideally, the funds collected are more than enough to cover the cost of employees' care throughout the year. Providing plan participants with useful information about healthcare costs and opportunity to compare prices at various providers can help self-funded plans keep their costs down.

Self-funded plans offer the opportunity to customize healthcare coverage based on the needs of employees. In some cases, they are also lower risk for companies, as the risk pool is made up of employees at the company and no one else.

The Phia Group, LLC, Offers Consultation & Self-Funded Plan Evaluation Services

The most recent pricing transparency law is just the start of a possible sea change when it comes to how patients understand healthcare costs. Transparency rules can increase the complexity of self-funded plans and require plan administrators to keep up.

The Phia Group, LLC, provides consulting services to ensure your self-funded plan remains in compliance. Contact us today to learn more and schedule a self-funded plan evaluation.