The Phia Group’s 1st Quarter 2024 Newsletter

The Phia Group is off to a great start in the first quarter of 2024! Check out our newsletter to get acquainted with some of the latest happenings in our neck of the woods.

|

||

|

||

|

|

|

|

At industry events, we will frequently ask attendees for a word or quality they attribute to The Phia Group. We then take those words and phrases, and use them to illustrate a “word cloud,” where the more popular answers are larger and the unique responses are smaller. I love seeing what others think of us, and I always print the image and frame it in my office. On a consistent basis, phrases like “Passion,” “Loyalty,” and “Innovative” dominate the image. How wonderful it is to be appreciated for those types of qualities; things that are ingrained in our mentality and personality. |

|

|

Yet attitude is not enough. You must be able to “put your money where your mouth is.” It’s one thing to be a thought leader. It’s another thing entirely to be an action leader. Passion and loyalty lead us to care about the industry we serve. Caring about this industry in turn leads us to learn. Maybe that’s why my personal Phia Group word cloud features a different word – big, bold, and in the center of the image. That word is “KNOWLEDGE.” Without in-depth understanding of how our industry works, what our clients need, and how the various players interact, all the world’s passion, loyalty, and innovation wouldn’t amount to more than hot air. The Phia Group is knowledge. Yet, like attitude, so too knowledge is not enough. Whether it is Leonardo da Vinci who said, “I have been impressed with the urgency of doing. Knowing is not enough; we must apply. Being willing is not enough; we must do…” or, G.I. Joe that reminded us kids that, “Knowing is half the battle,” the real challenge is transforming all of The Phia Group’s knowledge into something tangible, transferable, and useful. Not only is it important to us that we enrich our clients, but even amongst our staff members we seek to deliver knowledge efficiently and effectively. Thankfully, technology continues to provide tools we can use to package and deliver knowledge. In the past, we would spend hundreds of hours gathering, organizing and updating our internal and industry communication materials and deliverables, but now with artificial intelligence (A/I) so much of the delay between gaining and sharing knowledge has been minimized. Today, every service we offer and every piece of technology we utilize in support of those services leverages technology (like A/I) to improve timing and quality of deliverables. Maybe the inclusion of “innovative” in the word cloud is justifiable after all? Importantly – we don’t view this as a justification for lay-offs or slowing growth. We see technology as a way to make each individual an even more valuable contributor, and at The Phia Group, we can rarely have too much of a great thing. We continue to grow and expand, while also offering much faster turnarounds and reduced costs. In fact, I can argue that because of this focus on leveraging technology to use and distribute knowledge, we have obtained more new business more quickly than ever before. That, in turn, results in more career opportunities for our existing team members, more openings for prospective team members, improved services and deliverables for our clients, and an even larger pool of clients from whom we can all learn. This year, 2024, will be the year that we take A/I and all of our latest innovations to the marketplace – combining our legal prowess and vast amount of industry expertise with the latest technical tools – in a fashion never seen before. This will in turn result in opportunities for success and growth for all. We are excited about this journey and see 2024 as the year The Phia Group takes it to a new level of breakthroughs. The self-funded health benefits industry has never been bigger, busier, or more complex – let us help you ride the wave and avoid getting soaked. Happy reading! |

||

|

||

|

Though it is not yet available directly to ICE users, Phia’s consulting department has begun to use our new artificial intelligence (AI) tool, affectionately named soPhia, to assist with certain tasks and information sharing. Maybe most importantly, soPhia gives our very own Jennifer McCormick a way to troubleshoot her own Microsoft Excel problems – so our consulting attorneys can spend more time on ICE users’ consulting submissions, and less time fixing Jen’s computer. We’re excited to keep expanding soPhia’s capabilities and eventually share it with our clients! Service Focus of the Quarter: Unwrapped, BBR & Patient Defense Through our Phia Unwrapped service – combined with Balance Bill Resolution and Patient Defense – The Phia Group offers a suite of comprehensive end-to-end balance bill resolution services, ensuring that benefit plans and plan participants alike have independent but coordinated advocacy. Phia’s team of over 30 specialists and attorneys, bolstered by in-house medical coding and clinical resources, provides regulatory and legal expertise and over 15 years of reference-based pricing support experience. These services also include plan member legal representation by an external law firm, as well as the Phia “Safeguard,” guaranteeing that groups will not pay more than 200% of Medicare rates. Clients can enjoy stability, simplified processes, and improved balance bill resolution by working directly with The Phia Group. We offer direct access to our unrivaled team for all balance bill issues at every stage, eliminating the need for complex middlemen arrangements or third-party escalations. Moreover, existing clients opting for The Phia Group’s direct contract in 2024 will continue to enjoy 2023 rates, emphasizing our commitment to providing value and excellent service in the balance bill resolution domain. Phia Case Study: Hidden Gag Clauses A TPA recently engaged Phia to review certain health plan agreements for compliance with the gag clause prohibition. The TPA let us know that their counsel went through them and found nothing problematic, but that they’d appreciate a second set of eyes. For the most part, we found no prohibited gag clauses; the plan’s vendors had generally done a thorough job of removing any historical gag clauses. In one agreement, however, we found a questionable provision. Specifically, this provision did not explicitly identify information that constitutes a gag clause such that it was not glaringly obvious, but it did allow the vendor to unilaterally deem any information proprietary and subject to confidentiality at its discretion. Even though this is not an explicit gag clause, it is nonetheless a potential gag clause, which is sufficient to trigger the prohibition, since the vendor could simply decide to make it a gag clause! We pointed it out to the TPA who promptly relayed the information to the vendor, who stated their disagreement with our interpretation. We suggested that the TPA ask the vendor to simply remove the discretionary nature of the confidentiality clause, and though the vendor was hesitant, its general counsel eventually conceded that while she didn’t personally think it constituted a gag clause, it was “not impossible” that some could hold that opinion (a.k.a. the attorney equivalent of a “you’re right”). The vendor agreed to modify the provision by more clearly delineating what information was confidential and not allowing the vendor to deem information confidential other than what was identified in the agreement. Within 11 business days of sending us the request, the vendor and plan had signed an amendment, and the health plan was able to attest that that agreement in fact had no gag clauses! Fiduciary Burden of the Quarter: Abiding by the No Surprises Act The No Surprises Act, or NSA, is a sweeping piece of federal legislation that grants and imposes certain rights and responsibilities onto health insurers, medical providers, and individual patients. Given its breadth and the general public’s inability to read Congress’ mind, some parts of this law raise more questions than answers. This quarter’s Fiduciary Burden of the Quarter will focus on one oft-forgotten but incredibly important piece of guidance: the prohibition on applying plan exclusions. Yes, you read that right. According to a section of the Public Health Service Act as amended by the NSA (found here), a health plan is required to cover an emergency service “without regard to any other term or condition of the coverage, other than” cost-sharing, a permissible waiting period, or “the exclusion or coordination of benefits.” In other words, the plan must cover the emergency claim unless benefits are excluded. That seems intuitive, though, right? Coverage is required unless it’s excluded – the way health plans normally work. That should be simple enough to interpret. Apparently not. In a publication entitled “Requirements Related to Surprise Billing; Part I” (found here), the relevant regulatory bodies got together and issued guidance that turns cost-containment on its head. Specifically, this guidance provides that health plans may not “deny benefits for a participant, beneficiary, or enrollee with an emergency medical condition that receives emergency services, based on a general plan exclusion that would apply to items and services other than emergency services.” That would render exclusions like, for instance, those related to illegal acts unenforceable with respect to emergency services. So there we have it: Congress explicitly wrote that a plan can enforce the “exclusion of benefits” in a given emergency case, but subsequent regulatory guidance interpreted this language as meaning that a “general plan exclusion” cannot be enforced. Where does this leave us? Well, confused, to be honest. Did Congress really intend for health plans to be required to pay for any emergency claim even if the circumstance is clearly subject to a plan exclusion? The regulators say “Yes, patients need to be protected!” To that, we say “But so do health plans!” For the time being, though – until there’s guidance or a lawsuit to the contrary – we’re left with the regulatory guidance prohibiting health plans from excluding emergency claims based on any exclusion deemed “general” within the plan document – that is, any exclusion that applies regardless of the emergency nature of the claim. • On November 15, 2023, The Phia Group presented “Strategizing for 2024: New AI Regulations and Transparency Rules Impacting Healthcare,” in which we discussed technological and legal improvements that are sure to dictate how you survive and thrive in the coming year. • On October 18, 2023, The Phia Group presented “Cell and Gene Therapy: Industry and Claim Cost Impact,” in which we discussed frightening trends in drug costs, defined the risks, and presented solutions you can implement today. Be sure to check out all of our past webinars!

Empowering Plans

• On December 21, 2023, The Phia Group presented “Back to December (Phia’s Version)” in which our hosts, Kendall Jackson and Corey Crigger, discussed how everything in PGC and Provider Relations has changed in 2023. • On December 8, 2023, The Phia Group presented “Entering the Danger Zone: Cross-Plan Offsetting,” in which our hosts, Jon Jablon and Cindy Merrell, discussed the practice of cross-plan offsetting and the recent settlement between the Department of Labor and EmblemHealth Inc. • On November 21, 2023, The Phia Group presented “Copay Accumulator Programs Take a Hit: What’s Next?,” in which our hosts, Brady Bizarro and Andrew Silverio, discussed a recent federal court decision that saw drug manufacturers and patients alike score a victory against copay accumulator programs – programs that help maximize the manufacturer assistance available to patients but decline to count those amounts toward deductibles and out-of-pocket maximums. • On November 9, 2023, The Phia Group presented “No Surprises Act Brings More Surprises & Other Surprises for 2024,” in which our hosts, Brian O’Hara and Kelly Dempsey, discussed a couple lesser-known items hidden in some NSA proposed rules. • On October 26, 2023, The Phia Group presented “PCORI and Parity and Lawsuits, Oh My!,” in which our hosts, Jennifer McCormick and Nick Bonds, discussed some of the scary issues creeping up on health plans: rising PCORI fees, proposed regulations on mental health parity rules, and two fascinating court cases that may have significant implications for ERISA plans going forward. • On October 12, 2023, The Phia Group presented “Gene-y in a Bottle: A Magical Overview of Cell and Gene Therapy,” in which our hosts, Ron Peck and Corey Crigger, discussed how this emerging treatment can impact self-funded health plans. Be sure to check out all of our latest podcasts! • Self-Insurers’ Publishing Corp. – The Self-Insured Health Plan Compliance Clock Counts Down For 2023 – December, 2023 • America’s Benefit Specialist – Dissecting the CAA Gag Clause Prohibition – December, 2023 • Self-Insurers’ Publishing Corp. – Navigating Coverage for Weight Loss Medications – October, 2023 • BenefitsPro – Self-funding plan preparation for 2024 – October, 2023 • Is Artificial Intelligence the New Frontier for Healthcare? AI is not going anywhere – in the healthcare industry and beyond. • Minor Members and Third Party Settlements. Does a self-funded ERISA plan have a right of recovery from a minor’s third-party liability claim? • Being Mindful of Telemedicine Access. Telemedicine, being such a convenient and effective alternative to traditional in-person care, has helped meet the unprecedented demand for mental health services and more. • Update on the Federal IDR Process. Recently there has been significant discussion about the federal IDR process. • District Court Strikes a Blow to Copay Accumulator Programs. Several patient groups brought a legal challenge against HHS and CMS, challenging the NBPP as unlawful. To stay up to date on other industry news, please visit our blog. At The Phia Group, we value our community and everyone in it. As we grow and shape our company, we hope to do the same for the people around us. The Phia Group’s 2024 charity is the Boys & Girls Club of Metro South.

The mission of The Boys & Girls Club is to nurture strong minds, healthy bodies, and community spirit through youth-driven quality programming in a safe and fun environment. The Boys & Girls Club of Metro South (BGCMS) was founded in 1990 to create a positive place for the youth of Brockton, Massachusetts. It immediately met a need in the community; in the first year alone, 500 youths, ages 8 to 18, signed up as club members. In the 30-plus years since then, the club has expanded its scope exponentially by offering a mix of Boys & Girls Clubs of America (BGCA) nationally developed programs and activities unique to this club. Since their founding, more than 20,000 youths have been welcomed through their doors. Currently, they serve more than 1,000 boys and girls ages 5-18 annually through the academic year and summertime programs.

Thanksgiving Delivery! The tradition continues! The night before Thanksgiving, The Phia Group once again had a large contingent of volunteers helping to hand out Thanksgiving meals at the Boys & Girls Clubs of Metro South. Twenty-six families received dinners and each child received a gift from Adam Russo. We hope everyone had a great Thanksgiving!

Angel Tree at Phia Our Angel Tree was on display in our Canton office! We are thrilled to share that this marks our 10th consecutive year participating in the Salvation Army Angel Tree program. We had 150 tags on our tree this year, which means that we got to bring joy to 150 children this holiday season. Discover more about this heartwarming initiative that brings us so much joy in the link below: Angel Tree’s Site.

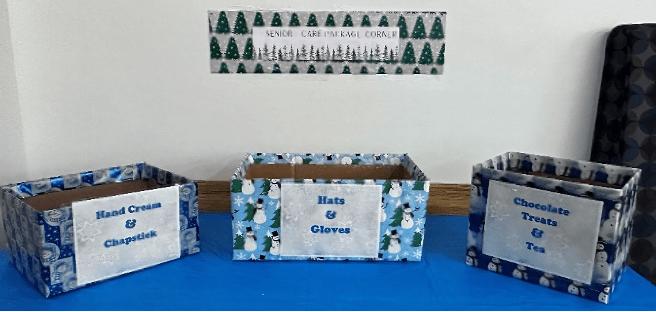

Senior Care Package Corner Through the Angel Tree Program, The Phia Group spread holiday cheer to dozens of seniors in the Greater Boston area, many of whom do not have families who are local. Thanks to the generosity and dedication of our employees, a Senior Care Package Corner was set up for the collection of basic necessities such as hats and gloves as well as some tasty treats. The Phia Group continues to look forward to making a difference in our local community in the upcoming year.

Santa’s Special Delivery On the evening of Tuesday, December 21, The Phia Group – with CEO Adam Russo serving as Santa, accompanied by a dozen elves – delivered gifts to 150 kids at the Brockton Clubhouse of the Boys & Girls Clubs of Metro South. We hope they enjoyed all of the gifts they received!

Phia News: Ping-Pong Tournament The Phia Group would like to congratulate Tomasz Olszewski on winning Round Two of its inaugural Ping-Pong Tournament. Tomasz is a great ping-pong player and will look to defend his title during the next round of the exciting tourney.

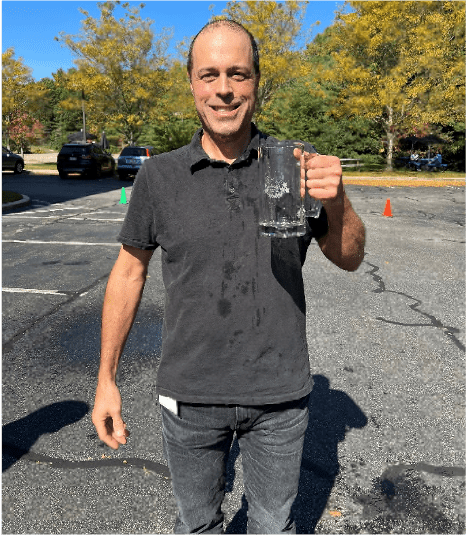

Stein Holding Challenge Our arms may have been sore but at least our bellies were full. The Phia Group celebrated Oktoberfest in style with a stein holding challenge (congrats Pete Kotsifas) and barbeque under postcard weather in Canton. What a way to usher in October … even if it didn’t feel like it outside in the Northeast.

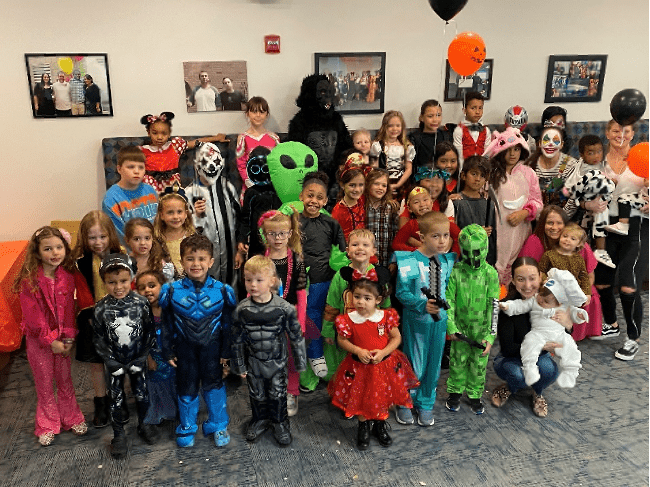

Halloween at Phia Late in October, many of our employees brought in their children for the annual Halloween extravaganza at our Canton headquarters. Everyone – kids and adults alike – had a blast trick-or-treating around the office and then enjoying a delicious pizza party afterwards! On behalf of everyone here at The Phia Group, we would like to thank all those who made that day so special for the Phia Phamily kids!

As is tradition, Phia held its annual Halloween costume contest. The Phia staff did not disappoint. We could only choose one winner from the group, but the winner was clear. Congratulations to Rebekah McGuire-Dye, who dressed up as Ursula! Check out her amazing costume below.

Candy Corn Contest As is tradition, Phia held its annual Candy Corn Contest. The Phia Family made some great guesses, but there was one person who came particularly close to guessing the exact number. Congratulations to Matt Kramp on guessing 801 pieces of candy corn. This was a very close guess, as we had 800 pieces of candy corn in the jar!

Ugly Sweater Contest The Ugly Sweater Contest was in full swing the last week of December, and the Phia family came together to vote one person as the winner of the owner of the ugliest sweater. The winner of the Ugly Sweater Contest was Regina Cattel! Congratulations and wear that sweater proudly!

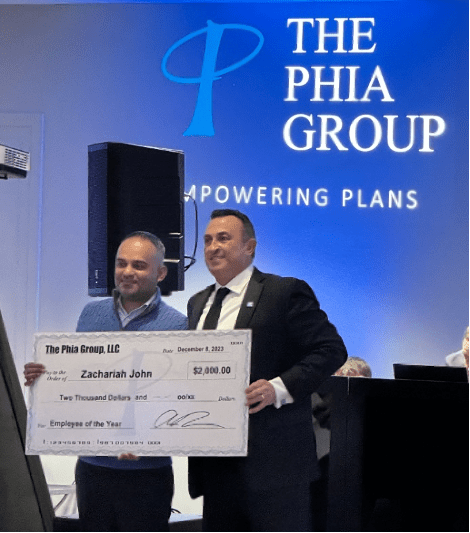

Get to Know Our Employee of the Quarter: Zach John To be designated as an Employee of the Year is an achievement that is reserved for Phia employees who truly go above and beyond their day-to-day responsibilities. This person must not only transcend their established job description but also demonstrate dedication and passion to The Phia Group and its employees that is so unparalleled that it cannot go without recognition. The Phia Explore team has made the unanimous decision, without hesitation, that there is no one more deserving than our very own Zach John as The Phia Group’s 2023 Employee of the Year! Here is what someone at Phia had to say about him: “Zach John joined Phia in 2016 and has been a tremendous contributor since day one. We have grown from one enterprise application (TPS) to six different applications on which Phia business is running today. Zach has been enhancing and maintaining all these applications with his team and has been doing it with an excellent attitude. Zach has grown a lot as a leader, and his accountability on getting things done and owning it is phenomenal. He is a true Phia idol employee who walks the talk and is appreciated by everyone. There is one thing to do your job, but it is another to do it with patience and empathy. He shows a lot of respect and accountability with business and his team alike. I am proud to have him as part of my team. He has been called the Flash for getting things done so quickly.”

Congratulations Zach, and thank you for your many current and future contributions. Get to Know Our Employee of the Quarter: Daiana Williams Being named Employee of the Quarter is an achievement that is for Phia employees who truly go above and beyond their responsibilities. This person must not only transcend their established job description but also demonstrate such unparalleled dedication and passion to The Phia Group and its employees that it cannot go without recognition. The Phia Explore team has unhesitatingly made the unanimous decision that there is no one more deserving than our very own Daiana Williams as The Phia Group’s 2023 Q4 Employee of the Quarter! Here is one person’s comments about Daiana: “Daiana is the rock in the recovery team. Not only is she the go-to for daily questions and stats, but she is the go-to for projects. When new ideas are being brought to the development team, Daiana is heavily involved. Not only does she test the enhancements before they go live, but she also quite literally is writing the guidelines and what is needed for this enhancement to go to development. Daiana works endless hours to get these going and successful for the team, and I don’t think she gets enough credit on how appreciative we are for this. In addition to everything else, she is also training new hires and working with them daily to guide them to success.” Congratulations Daiana, and thank you for your many current and future contributions. Phia Attending the SIIA National Conference Several of Phia’s industry experts will attend SIIA’s 2024 National Conference in Phoenix, Arizona, from September 22nd – 24th. If you are interested in attending or learning more about SIIA’s National Conference, visit their website: Get more details: SIIA 2024 Page

• Claims Specialist • Client Success Manager • Contract Administrator • Claim and Case Support Analyst • Case Investigator • Senior Subrogation Attorney • Sr. Claim Recovery Specialist See the latest job opportunities, here: Our Careers Page Promotions • Bill Parlee has been promoted from Case Investigator to Claim Recovery Specialist IV. • Deonte Small has been promoted from Accounting Assistant to Accounting Administrator. New Hires • David Patrick was hired as a KP Claim Recovery Specialist. • Alex Stoner was hired as a KP Claim Support Analyst. • Matthew McKenzie was hired as a KP Claim Recovery Specialist. • Amy Justice Isaacs was hired as a KP Claim Recovery Specialist. • Shane Kepley was hired as a Claim Specialist. • Whitney Hester was hired as a KP Recovery Manager and Training Specialist. • Kevin Nealon was hired as a Claim and Case Support Analyst. • Ryan Kramer was hired as a Project and Operations Coordinator. • Jackie Ryan was hired as an Accounting Administrator. • Lesly Chavez was hired as a Customer Service Representative. • Chasitie Bryce was hired as a Customer Service Representative. • Roshaun Jones was hired as a Sr. Customer Service Representative. • Neil McCarthy was hired as a Claim Analyst. • Vanessa Leurini was hired as a Case Investigator. • Matthew Robinson was hired as a Director, Recovery Service Onboarding and Support. • John Gullett was hired as a Subrogation Attorney. • Spencer Mahne was hired as an Accounting Admin. • Nikki Wheeler was hired as a Director, Customer Service and Case Evaluation. The Phia Group Reaffirms Commitment to Diversity & Inclusion At The Phia Group, our commitment to fostering, cultivating, and preserving a culture of diversity and inclusion has not wavered from the moment we opened our doors 20 years ago. We realized early on that our human capital is our most valuable asset, and fundamental to our success. The collective sum of individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work, represents a significant part of not only our culture, but also our company’s reputation and achievements. We embrace and encourage our employees’ differences, including but not limited to age, color, ethnicity, family or marital status, gender identity or expression, national origin, physical and mental ability or challenges, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique. The Phia Group’s diversity initiatives are applicable to all of our practices and policies, including recruitment and selection, compensation and benefits, professional development and training, promotions, social and recreational programs, and the ongoing development of a work environment built on the premise of diversity equality. We recognize that the success of our company is a direct reflection of each team member’s drive, creativity, diversity, and willingness to exercise initiative. With this in mind, we always seek to attract and develop candidates who share our passion for the healthcare industry and our commitment to diversity and inclusion.

|

||

|

||